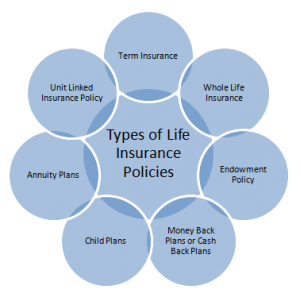

All life insurance policies are not created equal. Understand how the different types of life insurance work.

All types of life insurance policies pay a specified amount of money if something happens to you. That said, not all policies are the same. Before choosing a life insurance policy, be sure you understand what type of insurance policy you are choosing and how it works.

"Before choosing term life insurance, check premium rates for older ages and find out how long the policy can be continued."

Term Life Insurance

Term life insurance is insurance coverage for a designated period of one or more years. Benefits are paid only if something happens within that specified term. In general, this type of insurance pays the highest immediate benefit for your premium dollar.

Features of Term Policies

Renewable Term Policies

Some term policies are "renewable" for one or more additional terms, even if your health changes. Each time you renew, premiums increase. Before choosing term life insurance, check premium rates for older ages and find out how long the policy can be continued. This is usually stated as "renewable until age

Some term policies are "renewable" for one or more additional terms, even if your health changes. Each time you renew, premiums increase. Before choosing term life insurance, check premium rates for older ages and find out how long the policy can be continued. This is usually stated as "renewable until age

Convertible Term Policies

Some term policies are also convertible. This means that before the end of the specified conversion period, you may choose to trade the term policy for a whole life or endowment policy—even if your health changes. Premiums for the new policy will be higher than the original term policy rates.

Whole Life Policies

Whole life insurance provides death benefits for as long as you live. The most common type of whole life insurance is "ordinary" life. With this kind type of whole life insurance, your premium rates never change. It is important to note that ordinary life premiums can be much higher than term life insurance premiums, but they are smaller than the premiums you’d eventually pay if you kept renewing term policies in your later years.

Some types of whole life policies allow you to pay premiums for shorter periods of time, such as 20 years, or until age 65. This usually results in higher premiums than with ordinary life, because payments are made during a shorter time period.

Whole Life Policies and Cash Values

Whole Life Policies and Cash Values

Although whole life premiums are initially higher than term premiums, whole life policies develop “cash values.” Technically speaking, these are called “non-forfeiture benefits.” That means you do not lose the cash value if you stop paying premiums. If you are not able to continue paying for the policy, you can pay your premiums using the cash value, reduce the amount of the policy, or surrender the policy and take the cash value. If you choose to surrender the policy, you will no longer be covered with life insurance.

You may also borrow against the cash value with a loan.* Any money owned in the form of a policy loan is deducted from the benefit paid when you die, or from the total cash value if you stop paying premiums.